Awesome

pypme – Python package for PME (Public Market Equivalent) calculation

Based on the Modified PME method.

Example

from pypme import verbose_xpme

from datetime import date

pmeirr, assetirr, df = verbose_xpme(

dates=[date(2015, 1, 1), date(2015, 6, 12), date(2016, 2, 15)],

cashflows=[-10000, 7500],

prices=[100, 120, 100],

pme_prices=[100, 150, 100],

)

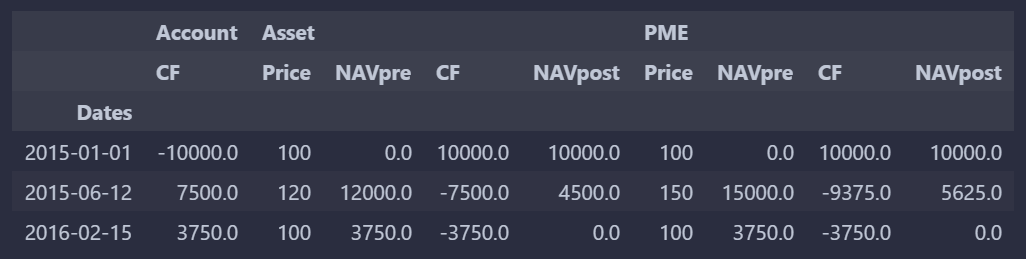

Will return 0.5525698793027238 and 0.19495150355969598 for the IRRs and produce this

dataframe:

Notes:

- The

cashflowsare interpreted from a transaction account that is used to buy from an asset at priceprices. - The corresponding prices for the PME are

pme_prices. - The

cashflowsis extended with one element representing the remaining value, that's why all the other lists (dates,prices,pme_prices) need to be exactly 1 element longer thancashflows.

Variants

xpme: Calculate PME for unevenly spaced / scheduled cashflows and return the PME IRR only. In this case, the IRR is always annual.verbose_xpme: Calculate PME for unevenly spaced / scheduled cashflows and return vebose information.pme: Calculate PME for evenly spaced cashflows and return the PME IRR only. In this case, the IRR is for the underlying period.verbose_pme: Calculate PME for evenly spaced cashflows and return vebose information.tessa_xpmeandtessa_verbose_xpme: Use live price information via the tessa library. See below.

tessa examples – using tessa to retrieve PME prices online

Use tessa_xpme and tessa_verbose_xpme to get live prices via the tessa

library and use those prices as the PME. Like so:

from datetime import datetime, timezone

from pypme import tessa_xpme

common_args = {

"dates": [

datetime(2012, 1, 1, tzinfo=timezone.utc),

datetime(2013, 1, 1, tzinfo=timezone.utc)

],

"cashflows": [-100],

"prices": [1, 1],

}

print(tessa_xpme(pme_ticker="LIT", **common_args)) # source will default to "yahoo"

print(tessa_xpme(pme_ticker="bitcoin", pme_source="coingecko", **common_args))

print(tessa_xpme(pme_ticker="SREN.SW", pme_source="yahoo", **common_args))

Note that the dates need to be timezone-aware for these functions.

Garbage in, garbage out

Note that the package will only perform essential sanity checks and otherwise just works with what it gets, also with nonsensical data. E.g.:

from pypme import verbose_pme

pmeirr, assetirr, df = verbose_pme(

cashflows=[-10, 500], prices=[1, 1, 1], pme_prices=[1, 1, 1]

)

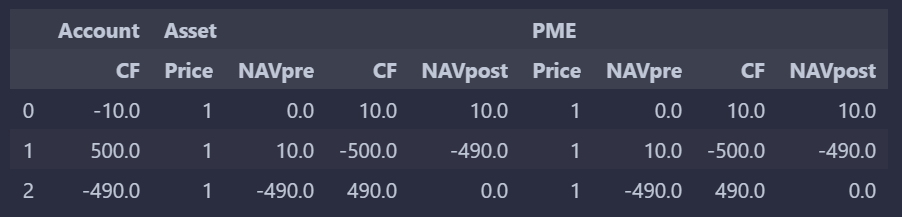

Results in this df and IRRs of 0:

Other noteworthy libraries

- tessa: Find financial assets and get their price history without worrying about different APIs or rate limiting.

- strela: A python package for financial alerts.